Services

CUSTOMS AND TAX ENGINEERING

In the global logistics landscape, Customs and Tax Engineering is an increasingly strategic function that enables businesses to navigate the complex web of international trade regulations, import/export compliance, duties, and taxes. It is the science and art of structuring supply chain operations and documentation in a compliant yet financially optimized manner, ensuring that cross-border transactions meet all legal obligations while minimizing tax exposure, customs duties, and trade delays.

As companies expand into global markets, customs and tax considerations can have a profound impact on logistics performance, total landed cost, cash flow, and overall competitiveness. Effective customs and tax engineering empowers companies to optimize trade flows, accelerate customs clearance, reduce risks of fines or audits, and leverage free trade agreements (FTAs) and other preferential trade mechanisms.

Understanding Customs and Tax Engineering

Customs and Tax Engineering involves a proactive and strategic approach to managing:

Customs clearance procedures

Import/export duties and tariffs

Indirect taxes (e.g., VAT, GST)

Trade compliance and documentation

Tariff classification and valuation

Duty deferral and exemption schemes

Free trade zone (FTZ) operations

Preferential origin planning and certificate management

It requires close coordination between logistics providers, supply chain managers, legal teams, and customs brokers to ensure that goods cross borders legally, quickly, and at the lowest fiscal burden.

Key Components of Customs and Tax Engineering

A. Tariff Classification Optimization

Correctly assigning the Harmonized System (HS) code to a product is the foundation of customs compliance. Misclassification can lead to overpayment of duties or costly fines. Engineering the classification strategically can also help leverage lower tariff rates, especially for multi-component or composite products.

B. Customs Valuation Strategy

- Accurate and legal customs valuation is crucial. Companies may optimize declared value by considering:

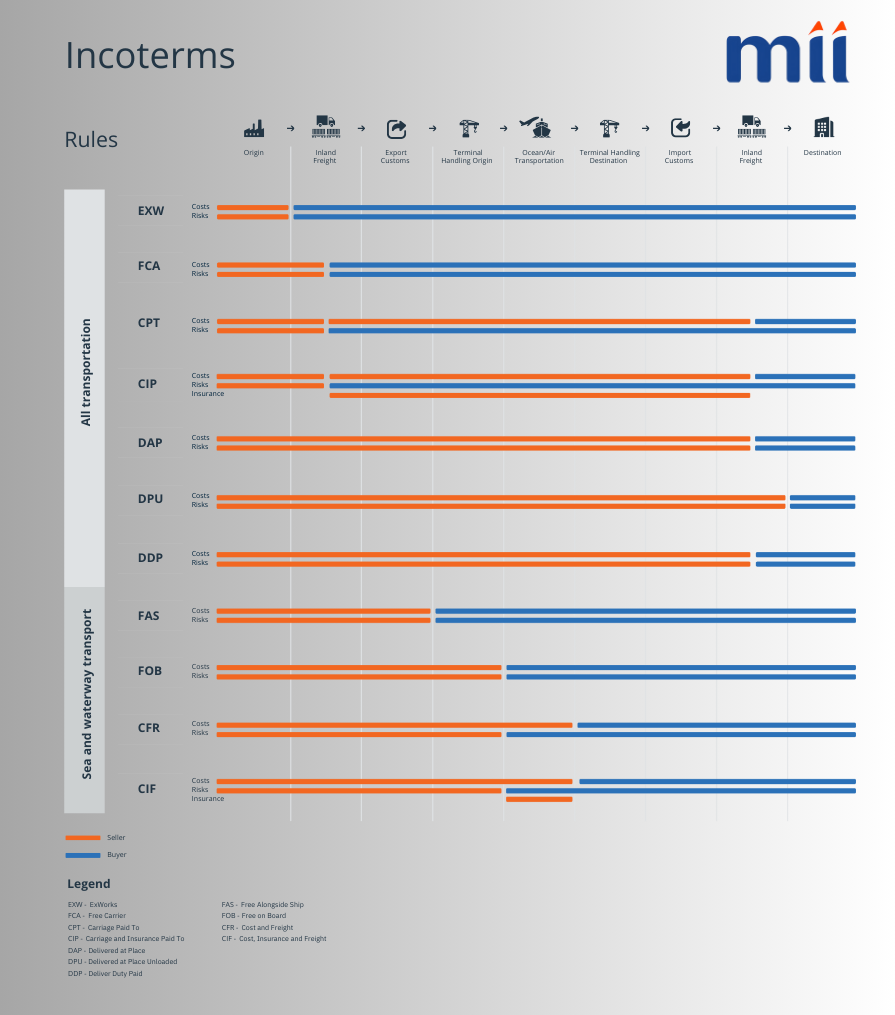

- Incoterms (which costs are included/excluded)

- Transfer pricing adjustments

- Royalties and license fees

- Additive or deductible costs (freight, insurance, commissions, etc.)

C. Origin Planning

Goods that qualify as originating under a Free Trade Agreement (FTA) may benefit from reduced or zero duties. Strategic tax engineering involves sourcing or processing goods in a way that meets origin rules, and maintaining robust documentation to prove eligibility.

D. Duty Mitigation and Recovery Programs

- Engineering customs processes to utilize duty-saving opportunities such as:

- Bonded warehouses and customs-controlled areas

- Duty drawbacks (recovering duties on re-exported goods)

- Temporary import regimes

- Inbound processing and outward processing reliefs

E. Indirect Tax Structuring

In cross-border logistics, taxes such as VAT or GST must be accounted for and managed properly. Structuring tax registrations, recovery mechanisms, and reverse charge rules can have a major cash flow impact, especially for multinational firms operating in multiple tax jurisdictions.

Benefits of Effective Customs and Tax Engineering

A well-implemented customs and tax strategy in logistics provides numerous benefits:

Reduced Duty and Tax Costs: Strategic classification and origin planning can significantly reduce fiscal obligations.

Faster Customs Clearance: Well-prepared documentation and compliance history facilitate green lane approvals.

Improved Cash Flow: Utilizing deferred payments, VAT reclaim, or bonded facilities delays or eliminates upfront tax payments.

Risk Reduction: Minimizes the risk of audits, penalties, and shipment delays.

Competitive Advantage: Lower landed costs translate into more competitive pricing in target markets.

MII Expertise

Customs and Tax Engineering is no longer just a compliance obligation, it is a strategic lever in the global logistics industry. When executed correctly, it enables businesses to lower operational costs, accelerate shipments, comply with global trade laws, and adapt to evolving market conditions. In a world where supply chains are more interconnected and regulated than ever, mastering the intricacies of customs and tax across jurisdictions is essential for resilience, agility, and profitability.

By integrating legal knowledge, trade policy, technology, and logistics operations, Customs and Tax Engineering turns a traditional pain point into a powerful driver of value in the modern supply chain.